Rebound year?

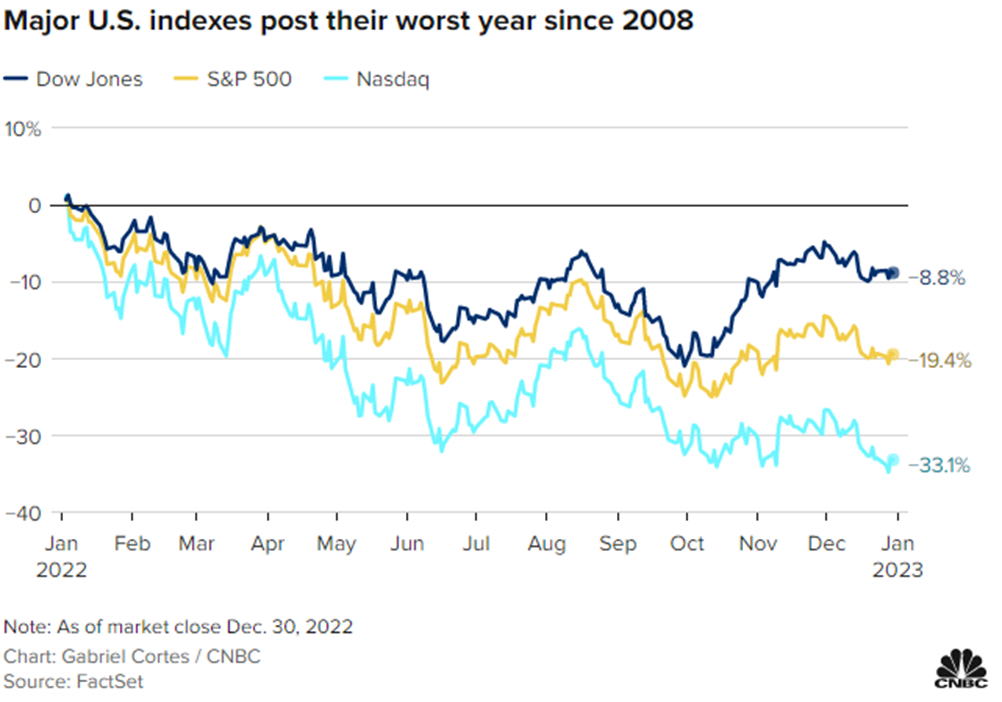

2022 was a particularly challenging year for markets and one that investors will not remember with fondness. We saw a significant decline in all major US market indices in what was the worst year for equities since 2008:

The equity indices, however, only tell part of the story. 2022’s market pain was deeply exacerbated by the challenges in the bond market. As a result of sharp and rapid interest rate increases to curb inflation, yields soared and bond prices fell precipitously. For example, longer dated US treasury debt was down over 35% in a nine-month period this past fall:

Source: Wall Street Journal

This is a staggering drop for government bonds which carry little to no default risk and illustrates just how severe the bond market shocks have been. As a result of the bond market turmoil, bonds failed to provide the hedging benefits they often provide in declining markets. Diversified portfolios consequently suffered one of their worst years in history.

As we look to 2023, the question on investor’s minds is whether the new year will be an extension of the pain of 2022 or if change is in the offing. Let’s consider both the bull (positive) and bear (negative) cases for 2023.

Bull Case

When we have a market pullback to the extent that we saw in 2022, history is on our side for a rally in the subsequent year. For example:

- Markets have ended the year in positive territory nearly 75% of the time going back to 1928

- Since 1928, markets have followed a down year with an up year over 60% of the time

- Post WWII, markets have followed a down year with an up year nearly 88% of the time

- The average bear market only lasts 1.2 years, while the average bull market lasts 5.7 years

- When markets drop 20% in six months (as happened in 2022), the average post drop return is over 31%

- Since 1950, every midterm election year has seen an intra-year drop and positive returns one year later with an average increase of 32.3% one year after the midterm drop

While historical data isn’t always predictive, the dice are very loaded for 2023 to be an up year. In addition to historical precedent, here are some other reasons for optimism in 2023:

- For the next two years, we have divided government and a “gridlock” scenario. Markets typically do their best with divided government

- With China moving beyond zero-COVID policies, 2023 may be the year we see some of the nagging supply chain issues resolved

- Inflation has started to tick downward (see below). If inflation continues to moderate in the coming months, interest rate increases may peak lower and sooner than anticipated. This would be a huge tailwind for markets and growth stocks in particular

- On the geopolitical front, China/Taiwan risk has cooled somewhat since the significant flare up last fall. This seems to be a function of China focusing inward as they’ve amended their COVID policy at least in part as a result of domestic unrest. With respect to the Russia/Ukraine war, the world seems to have adjusted to the economic fallout that the conflict has caused

- While the rate increases have raised the specter of a recession, said recession would likely be mild in nature. Moreover, equity markets are leading indicators, meaning that markets bottom out before the broader economy. This means that markets can rally even in a recessionary environment

Overall, there is much to be optimistic about with respect to 2023 and we view a bull case as the more likely outcome. That being said, risk always exists and 2023 is no exception. Below is the bear case for 2023 and some of the things that keep us up at night.

Bear Case

The primary areas of concern that could potentially lead to market declines are the following:

- Valuations and mark to market adjustments

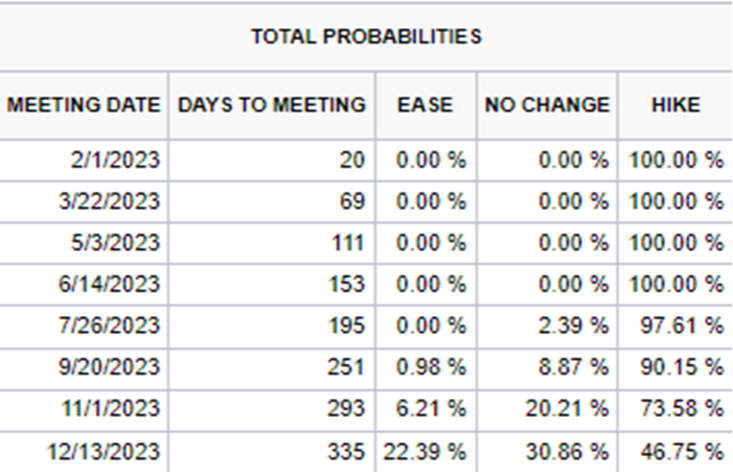

While market valuations have come down and many areas of the market are on sale, some valuation metrics remain high. The concern here is that markets potentially need to fall further to make prices low enough to attract heavy buying. Additionally, many market instruments (growth stocks and bonds in particular) experienced significant market value adjusting on the back of rising rates. As rates rose throughout 2022, growth stocks and bonds declined in value largely on the basis of new interest rates expectations. If the market is misinterpreting where rates plateau (futures suggest rate hikes continuing through the better part of the year, see below) we could experience further pain in instruments with high rate sensitivity.

Source: CME

- Challenges to the existing world order/geopolitical risk

The geopolitical landscape has changed significantly over the past 20 years and in particular, over the past 5-7 years. The post-Cold War world order is both changing and being challenged. Globalism and free trade are waning, and risk of great power conflict is more elevated than any time in certainly the post-Cold War era and perhaps the post World War II era as well. We have an ongoing war in continental Europe between a nuclear armed Russia and a NATO-supplied Ukraine. This past fall we saw significant Chinese escalation in the Taiwan Strait. US partners are questioning the strength of our security guarantees and in the coming years our hegemony will likely be challenged. History appears to be on the march and this period of time in many ways is not dissimilar to the period of time immediately prior to World War II. While our view is that the Russia/Ukraine war will likely continue to be ring-fenced to that area of the world and that broader escalation is unlikely, we can’t entirely discount the possibility of escalation.

On the China front, we view near-term military conflict as unlikely, but cannot discount the possibility entirely either. A Chinese invasion of Taiwan would be fraught with huge global implications. This is in our view a low-likelihood, high (catastrophic) impact event.

Additionally, we think about potential action by a bellicose North Korea, a preemptive strike on Iranian nuclear capabilities, and numerous other potential geopolitical disruptions.

As investors, if we avoided markets because of all potential global risks, we’d never invest. The price of admission as an investor is volatility and acceptance of the risk of low probability/high impact events. Prudence in this space means we have awareness, we plan for liquidity needs and have enough low volatility holdings to ride out potential geopolitical storms. While a large shock in 2023 is unlikely, a surprise in this space would ripple through financial markets.

- Federal Reserve policy

The Federal Reserve has a tight rope to walk in the coming months. They need to be sufficiently strong in raising rates to ensure that inflation is put to bed, but not raise rates so high that we’re pushed into deep recession. It is hard to get this balance correct and at least verbally they seem to be indicating that they will err on the side of raising rates too high. If they significantly overshoot on rate increases and a deep recession results, corporate earnings and consequently stock prices will feel the pinch.

Conclusion

Like any year, 2023 has potential upside and downside. As mentioned above, we view the bull case as more likely than the bear case, but investors are best served preparing for either contingency. Below is a rough playbook to help navigate 2023:

- Revisit your plan

Depressed markets offer the opportunity to “stress test” one’s plan. A financial model that takes into account fallen account balances, modest return expectations and realistic spending assumptions can be invaluable. A plan that passes muster under these assumptions should be confidence inspiring. If on the other hand such modelling suggests potential shortfalls, plan adjustments may be warranted.

- Rebalance

A tried and true method of helping portfolio success is periodic rebalancing. Consider rebalancing your portfolio by adding funds to beaten-down sectors to bring your portfolio back in line with targeted allocations

- Be disciplined with diversification

Diversification is particularly important in markets such as these. There is a significant temptation among investors to “chase the hot dot”. For example, in 2022 value stocks outperformed growth stocks and the temptation for an investor may be to ignore growth stocks and focus heavily on value. We know from market history that the worst performers in a given year may be the highest performers in a following year. A myopic focus on recent performance only is nearly always detrimental.

- Take advantage of higher yields

With the Fed’s rate increases, we’ve entered an entirely new rate regime. These higher rates bode well for the less risky parts of portfolios. Bond yields are significantly higher as are savings rates and the rates on insurance products. Consider taking advantage of these higher rates on the lower volatility parts of your portfolio

- Reassess your risk appetite

Declines like last year provide a real-world opportunity to experience risk and evaluate your true risk appetite. Be honest about how the market declines impacted your psyche. As humans, we feel the pain of loss more keenly than we feel the euphoria of a gain. Have frank conversations with your advisor around your risk tolerance and if your risk tolerance has changed, they can help you balance the pivot to lower your risk while still being sensitive to the risk of missing out on market rallies.

- Consider deploying dry powder

While we don’t know when market bottoms will occur, many segments of the market are very attractive. If you have a significant surplus of cash or an excess of defensive funds, consider putting some of this money to work in the market as the entry price today is very attractive for many assets.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Diversification, asset allocation and rebalancing strategies do not ensure a profit and do not protect against losses in declining markets. Rebalancing may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events may be created that may affect your tax liability.

Investing involves risk, including loss of principal. Supporting documentation for any claims or statistical information is available upon request.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

Alliance Wealth Advisors, LLC, is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability a SEC Registered Investment Advisor – 150 N. Main St. #202 Bountiful, UT 84010.